By April Rodgers, Freelance Journalist | FreeWire — Your News, Your Voice

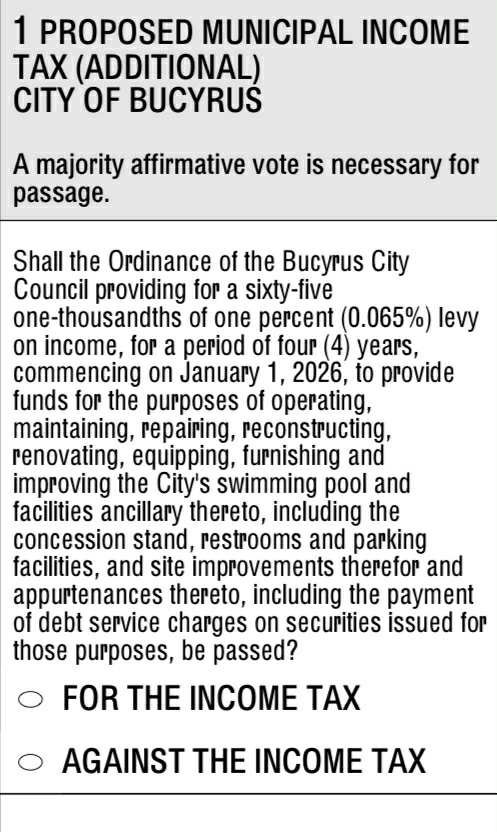

Bucyrus residents will see Issue 1 on the November ballot, a proposal that would add a small increase to the city’s income tax to fund improvements and upkeep of the city swimming pool and related facilities.

The measure, approved for the ballot by Bucyrus City Council, asks voters whether to authorize a 0.065 percent additional municipal income tax for a period of four years, beginning January 1, 2026.

If passed, the additional tax would be used to provide funds for operating, maintaining, repairing, reconstructing, renovating, equipping, furnishing, and improving the city’s swimming pool and its related amenities. Those include the concession stand, restrooms, parking areas, and other site improvements. The measure also allows funds to be used to pay debt service charges on any loans or securities issued for these purposes.

The increase would apply to residents and non-residents who earn income within Bucyrus city limits. The amount translates to about 65 cents for every 1,000 dollars of taxable income.

• A person earning 30,000 dollars a year would pay roughly 19.50 dollars annually.

• At 50,000 dollars, the additional tax would be about 32.50 dollars per year.

• Someone earning 75,000 dollars would pay around 48.75 dollars.

The proposed levy would expire after four years unless renewed by voters in a future election.

A “yes” vote supports the added 0.065 percent income tax for the pool improvements. A “no” vote keeps the current income tax rate in place, with no additional revenue for pool operations or repairs.

Early voting is now open in person at the Crawford County Board of Elections, located in the lower level of the Crawford County Courthouse. For full election details, sample ballots, and voting hours, visit the official website at www.boe.ohio.gov/crawford.